Misconceptions

Understanding the Employee Advance form can be tricky, and several misconceptions often arise. Here are seven common misunderstandings about this form, along with clarifications to help clear things up.

-

Misconception 1: The Employee Advance form is only for emergencies.

While it can be used for emergencies, this form is also available for planned expenses, such as travel or training costs.

-

Misconception 2: You need to repay the advance immediately.

Repayment terms can vary. Some advances allow for deductions from future paychecks, giving employees time to repay.

-

Misconception 3: All requests for advances will be approved.

Each request is reviewed based on company policy and individual circumstances. Approval is not guaranteed.

-

Misconception 4: Only full-time employees can apply for advances.

Part-time employees may also be eligible, depending on company policy. It’s best to check the specific guidelines.

-

Misconception 5: The form is complicated and difficult to fill out.

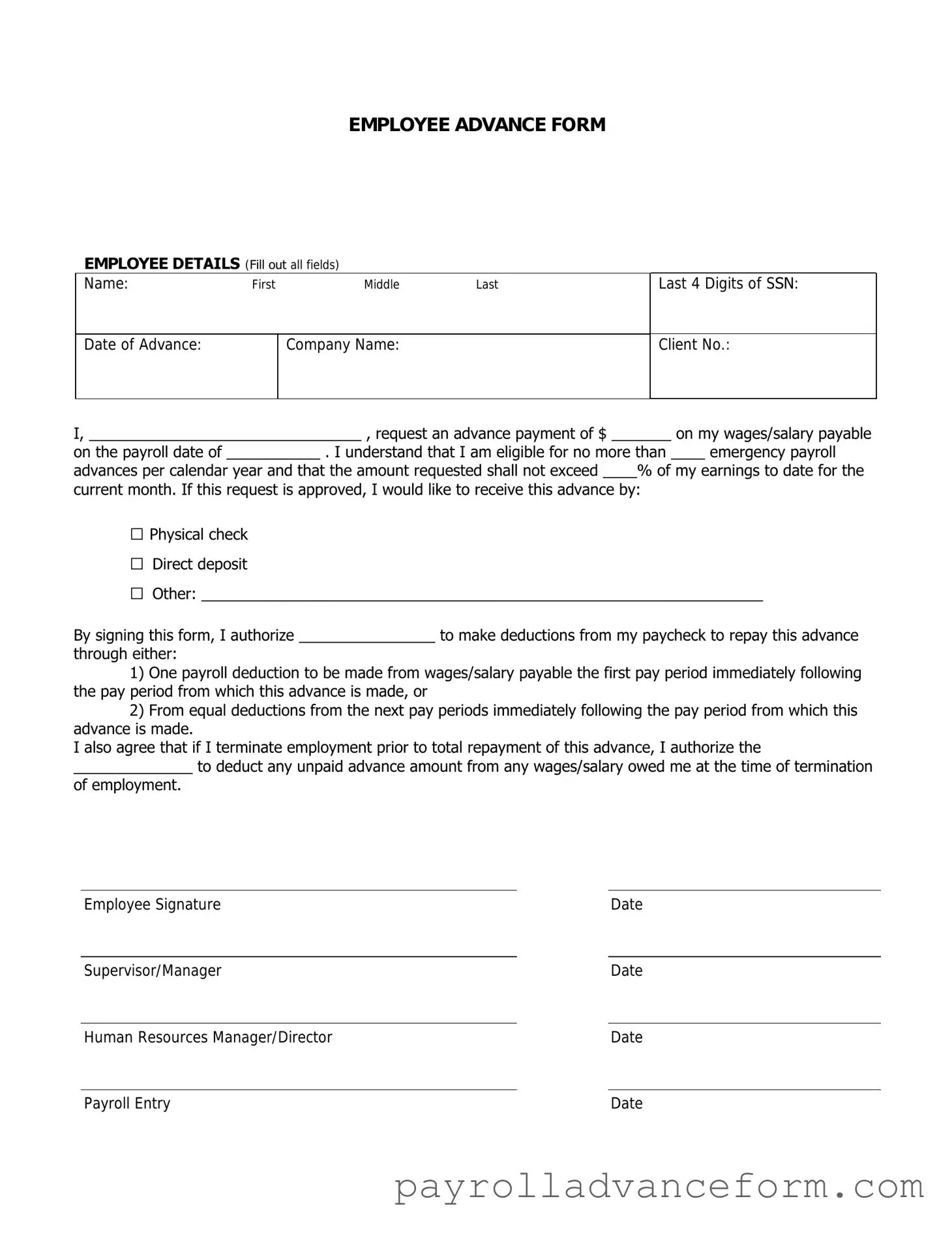

The Employee Advance form is designed to be straightforward. Most employees can complete it with basic information.

-

Misconception 6: You can only request an advance once a year.

There is typically no limit on the number of requests, as long as they are justified and align with company policies.

-

Misconception 7: Advances are taxable income.

Generally, advances are not considered taxable income until they are not repaid. Proper documentation is crucial.

By addressing these misconceptions, employees can better navigate the process of requesting an advance and understand their rights and responsibilities. Always refer to your company’s specific policies for the most accurate information.